STONECREST, GA – (June 23, 2021) – Stonecrest City Council will hold a virtual public

hearing on the proposed 2021 city millage rate during a special called meeting

on June 30, 2021, at 6:00 p.m.

Residents can watch the meeting live

on the City’s YouTube channel and may

submit public comments in advance of the hearing to the City Clerk at cityclerk@stonecrestga.gov. After the public hearing, Council plans to

vote on the matter during the same special called meeting.

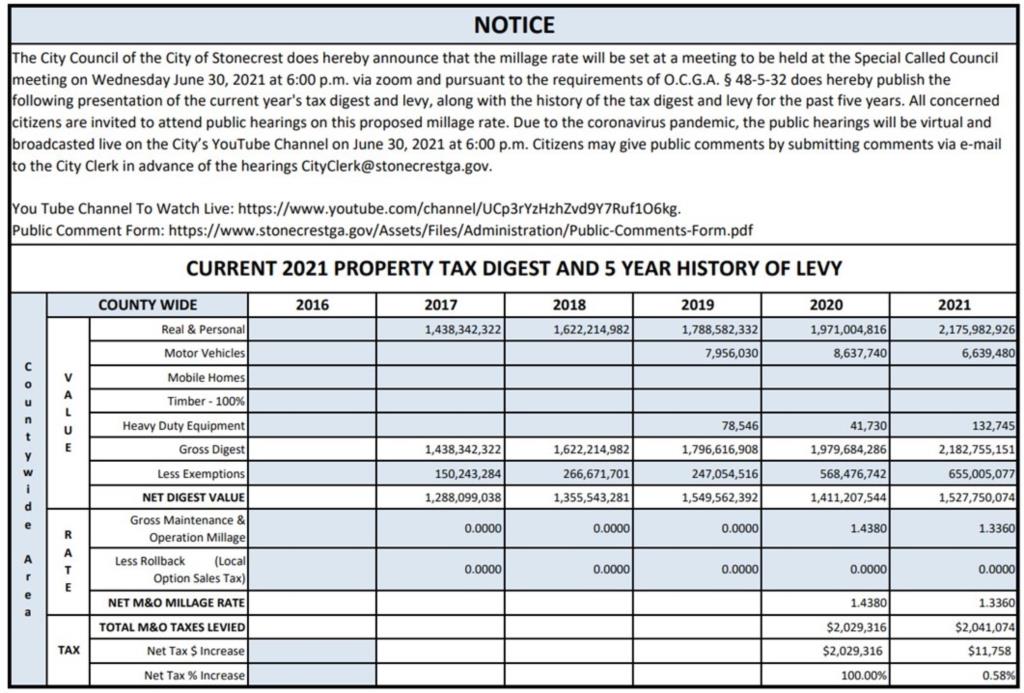

The proposed rate is 1.336 mills, which represents the calculated rollback rate, and means property owners within the City will pay the same property tax rate to Stonecrest as they did in 2020. The tax digest is shown below.

The following examples are offered to

help Stonecrest property owners understand what the city millage rate means for

them. For a home with a fair market value of $100,000 and no homestead

exemption, the proposed City property tax will be approximately $53.44, and for

a for non-homestead property with a fair market value of $300,000 the proposed

City tax will be $160.32.

As a reminder, DeKalb County

determines annual property assessments and provides annual notification to

property owners. For more information, please visit https://dekalbtax.org/.

We appreciate the community’s continued support as we work together to be a world-class city.